Do you lose your old age pension if you leave Canada?

Are you thinking about leaving Canada but worried about what happens to your old age pension? If so, you're not alone. Many Canadians wonder if they will lose their old age security (OAS) pension if they decide to move out of the country. The good news is that you can still receive your OAS pension even if you leave Canada. However, there are some important things you need to know before making the decision to move.

According to the Government of Canada, if you leave Canada for an extended period, you can still receive your OAS pension as long as you meet certain criteria. One of the key requirements is that you have lived in Canada for at least 20 years after the age of 18. This means that if you have been a resident of Canada for most of your adult life, you are likely eligible to continue receiving your OAS pension even if you move abroad.

Another important factor to consider is how long you plan to be out of the country. If you are planning to leave Canada for more than six months, you must notify Service Canada. This is important because if you fail to inform them of your plans to leave, your OAS pension may be suspended.

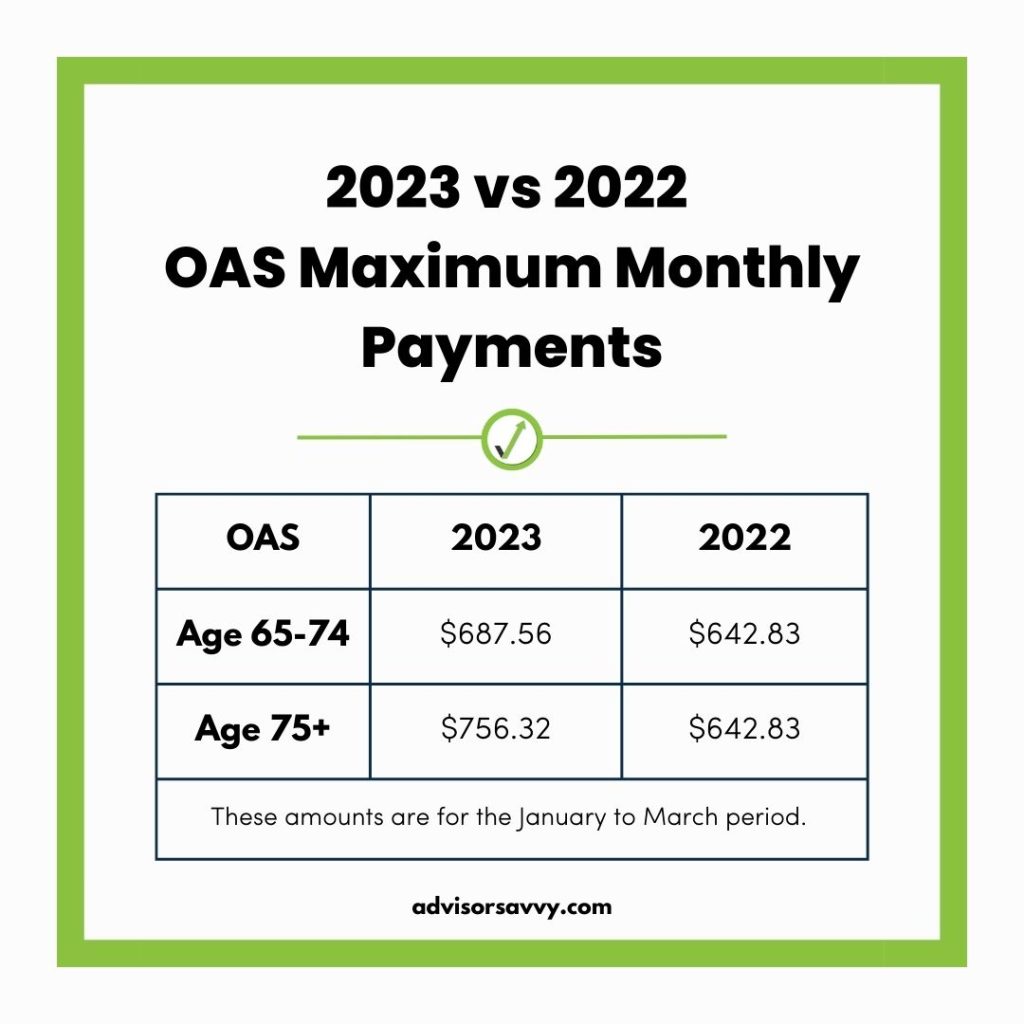

It's also worth noting that while you can still receive your OAS pension outside of Canada, there are some limitations to consider. For example, your pension may be subject to taxation in the country where you reside. Additionally, the amount you receive may be adjusted based on the cost of living in your new country of residence. These are important factors to keep in mind when deciding whether to move abroad.

In conclusion, if you are thinking about leaving Canada but are concerned about your old age pension, rest assured that you can still receive your OAS pension even if you move out of the country.

However, it's essential to meet the residency requirements and notify Service Canada if you plan to be away for an extended period. Additionally, be aware of any potential tax implications and adjustments to your pension amount based on your new country of residence. By understanding these key points, you can make an informed decision about your retirement plans without having to worry about losing your OAS pension.