How much is the old age pension in Canada?

One of the most important financial considerations for seniors in Canada is the Old Age Security pension. This monthly payment helps support Canadian seniors in their retirement years, providing them with financial security and peace of mind.

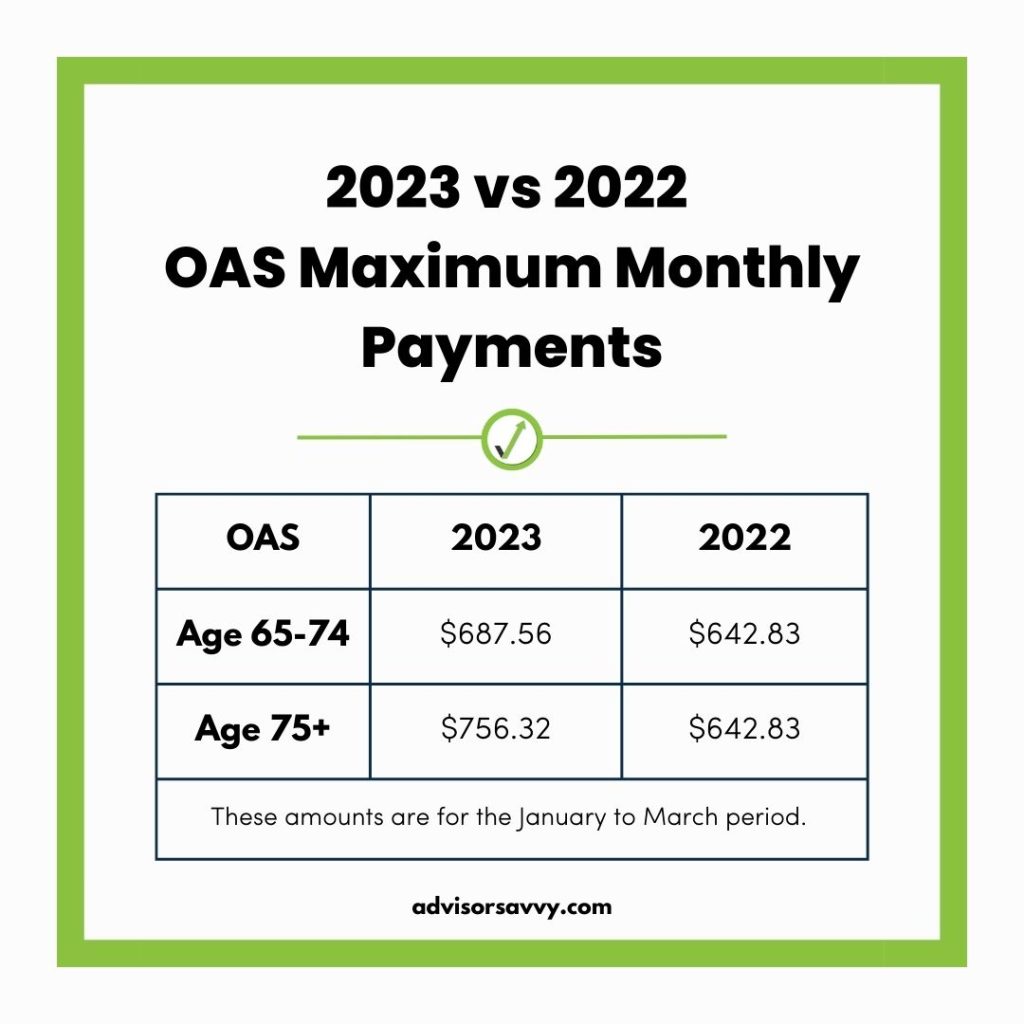

So, how much is the Old Age Security pension in Canada? The amount of the pension depends on several factors, including how long you have lived in Canada and your individual income level. Here's a breakdown of the different payment amounts:

1. The basic Old Age Security pension amount is $615.37 per month for seniors who have lived in Canada for at least 40 years after turning 18.

2. If you have lived in Canada for less than 40 years, you may still be eligible for a partial pension. The amount of this partial pension is calculated based on the number of years you have lived in Canada as an adult.

3. Seniors with a higher income level may be subject to a partial or full OAS clawback. This means that their pension amount may be reduced or eliminated based on their individual income level.

It's important to note that the Old Age Security pension is not taxed at the source, but it is considered taxable income. This means that you will need to report your OAS pension on your annual tax return and pay any necessary taxes on it.

Overall, the Old Age Security pension is a crucial source of financial support for Canadian seniors. Whether you are eligible for the full amount or a partial pension, this monthly payment can help supplement your retirement income and ensure that you have the financial resources you need to enjoy your golden years.