What benefits do you get when you turn 65 in Canada?

When you turn 65 in Canada, there are a variety of benefits that you may be eligible for. These benefits can help ensure that you have the financial stability and support you need as you enter your golden years. Here are some of the key benefits available to Canadians who are 65 and older:

Old Age Security (OAS)

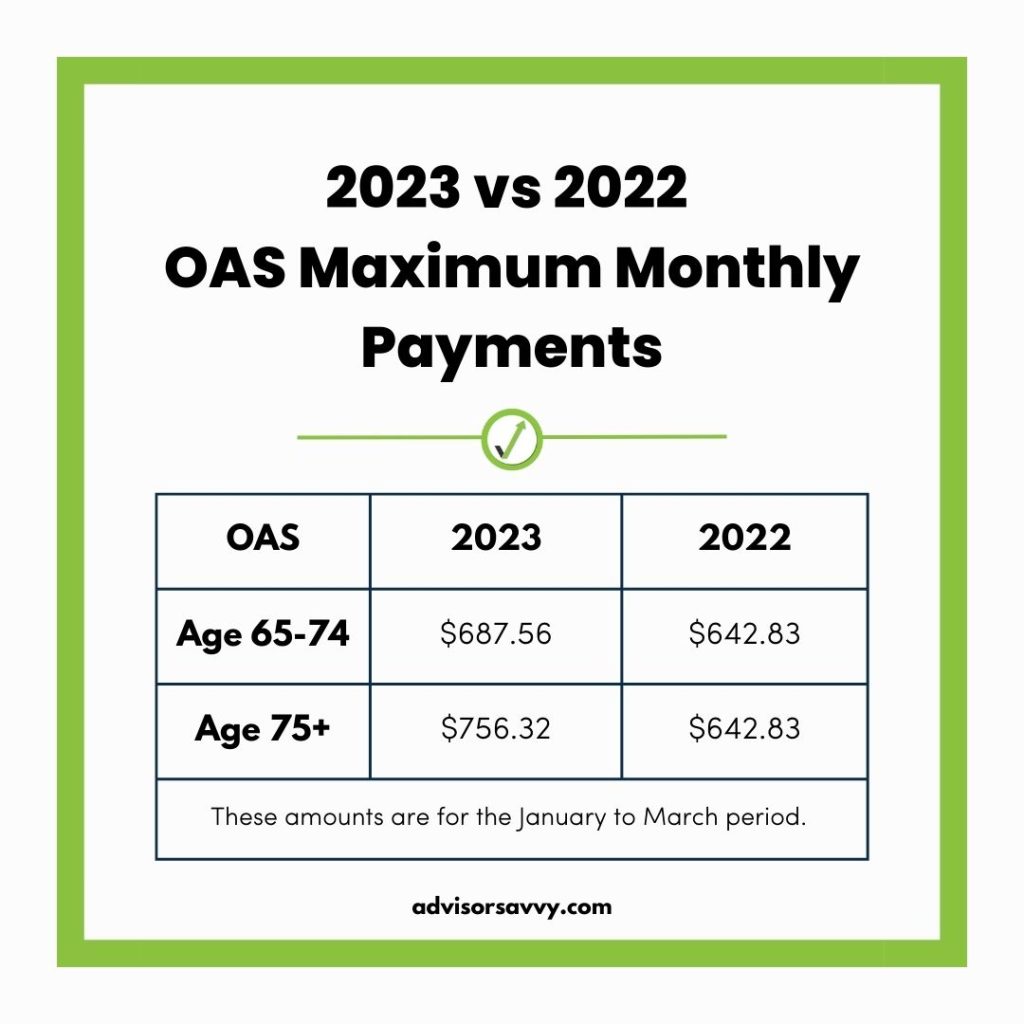

The Old Age Security (OAS) pension is a monthly payment available to Canadian seniors aged 65 and older who have lived in Canada for at least 10 years. The amount of the OAS pension you receive is based on how long you have lived in Canada after the age of 18. Currently, the maximum monthly OAS pension amount is $615.37. This pension is taxable, and the amount you receive may be adjusted based on your income.

Guaranteed Income Supplement (GIS)

The Guaranteed Income Supplement (GIS) is a monthly benefit available to low-income seniors who are receiving the OAS pension. The GIS provides additional financial support to seniors who have little to no other income. The amount of GIS you receive is based on your income and marital status, and can be up to $916.38 per month for a single person.

Allowance and Allowance for the Survivor

The Allowance is a monthly benefit available to low-income spouses or common-law partners of OAS pension recipients aged 60 to 64. The Allowance for the Survivor is a monthly benefit available to low-income widows, widowers, or survivors of a common-law partner who are aged 60 to 64. These benefits provide financial support to individuals who may be facing financial hardship after the death of a spouse or partner.

Canada Pension Plan (CPP)

The Canada Pension Plan (CPP) is a contributory, earnings-related social insurance program that provides retirement, survivor, and disability benefits. If you have made enough contributions to the CPP during your working years, you may be eligible to receive a monthly CPP retirement pension once you reach the age of 65. The amount of your CPP retirement pension is based on your earnings throughout your career, and the maximum monthly amount is $1,203.75.

Overall, turning 65 in Canada comes with a range of benefits that can help support you financially in your retirement years. These benefits provide a safety net for seniors who may be facing financial challenges or hardship, ensuring that they can enjoy a comfortable and secure retirement. If you are approaching 65 or have recently turned 65, be sure to explore the various benefits and programs available to you to make the most of your retirement years.